Today, every organization is vulnerable. But help is at hand.

Whether cyber-attacks or ethical AI issues, enterprises need a chief compliance officer (CCO) for AI compliance and other regulations.

They build policies and guide management on how employees must comply with laws to avoid litigation and reputation damage, also known as GRC (governance, risk, and compliance).

When CCOs build a culture of integrity into all processes across every organizational level, they enhance ethical behavior, compliance, employee engagement, and risk mitigation.

This approach makes the organization safe and secure and reduces wasted resources cleaning up after data breaches. This role may sound bureaucratic, but this is far from the truth, as CCOs are at the forefront of new technology acquisition decisions for every digital transformation.

59% of organizations report that third-party management is one of the highest corruption risks, yet 13% of financial organizations and many others report receiving pressure to approve these third-party partnerships. CCOs are experts in identifying, diagnosing, and overcoming these challenges.

This article defines the chief compliance officer and outlines skills and responsibilities. This information can help you understand the purpose of the CCO role, allowing you to hire one person or optimize how you communicate with and utilize them to increase compliance and fight organizational corruption.

What is a chief compliance officer (CCO)?

The Chief Compliance Officer’s primary role is to develop, implement, and oversee the organization’s compliance program.

As regulations evolve and the widespread use of technologies like large language models, such as ChatGPT, grows, the importance of the Chief Compliance Officer grows.

They act as gatekeepers of ethical conduct, ensuring the organization operates legally and doesn’t harm staff. They establish and maintain a robust compliance framework, protecting the company’s reputation and minimizing legal and financial risks.

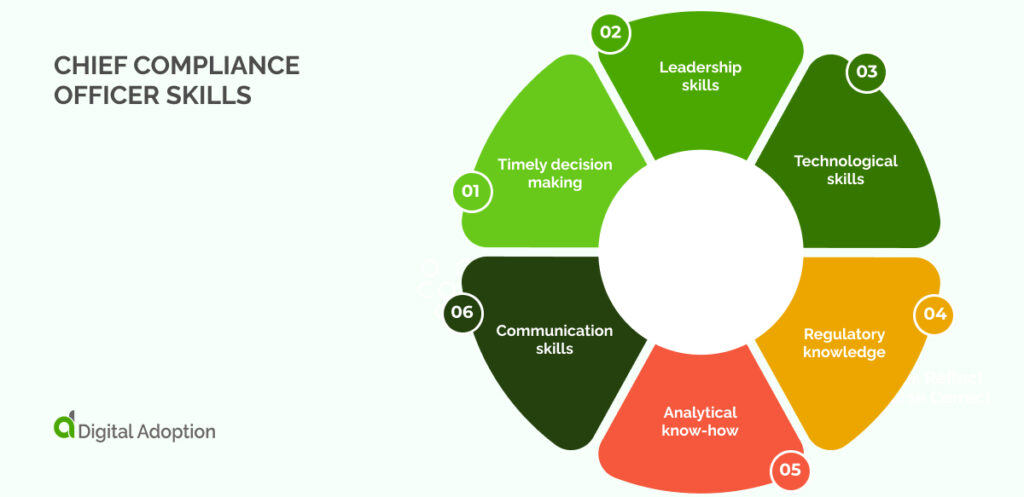

Chief compliance officer skills

Every CCO must hold several skills to fulfill their role adequately. Because the CCO is a C-suite position, many of these skills involve communication and leadership, so their knowledge trickles down to every level to ensure compliance throughout the organization.

However, CCOs must be technology experts, and many of their skills require updating their knowledge of new technologies to instruct managers on how to use them to ensure compliance as part of digital adoption strategies to use new technologies within ethical and regulatory frameworks.

Timely decision making

Timely decision-making is crucial for a Chief Compliance Officer because it ensures swift responses to regulatory changes, which CCOs can find on the US government website, minimizes legal risks and maintains compliance.

Quick decisions help address potential issues before they escalate, protecting the organization’s reputation and financial stability.

It’s also vital to do diverse global research to anticipate how US legislation might inform policy. For example, despite the US not having AI regulation, the EU passed the EU AI Act, and the US may follow a similar model.

Knowledge of the EU AI Act might help an enterprise prepare in advance to gain an advantage over competitors when the US creates an AI regulation policy.

By acting promptly, the CCO can implement necessary measures to uphold ethical standards and regulatory requirements, building a culture of accountability and trust.

This proactive approach helps the organization navigate complex regulatory landscapes effectively and efficiently.

Leadership skills

Leadership is vital for Chief Compliance Officers as they cultivate a compliance culture through strong leadership and work ethics.

Influential leaders balance decisiveness with respect, nurturing a positive tone at the top. Building trust and credibility is essential for long-term organizational sustainability.

By leading with integrity and setting an example, CCOs ensure compliance becomes ingrained in the company’s culture, promoting ethical behavior and adherence to regulations.

Technological skills

Technological proficiency is crucial for Chief Compliance Officers, enabling them to use compliance management software and automation tools effectively.

These skills streamline operations, simplify detailed monitoring, and expedite the audit-readiness process.

Familiarity with technology helps CCOs enhance efficiency, reduce errors, and ensure comprehensive compliance oversight. This expertise supports proactive management of compliance tasks, leading to better regulatory adherence and organizational performance.

Regulatory knowledge

Regulatory knowledge is the core of the Chief Compliance Officer role. Any CCO worth their fee will have a deep understanding of enterprise legal requirements and be able to interpret these laws.

Staying updated involves subscribing to newsletters, attending seminars and workshops, and pursuing certifications like CRCM (Certified Regulatory Compliance Manager). This approach ensures they can effectively navigate the regulatory landscape, ensuring the organization remains compliant and minimizing legal risks.

Analytical know-how

Analytical skills are essential for Chief Compliance Officers to navigate regulatory complexities. They need to identify the root causes of risks, analyze business impacts, and recommend appropriate mitigation strategies.

Evaluating different scenarios and assessing the effectiveness of corrective actions is equally important. These skills enable CCOs to make informed decisions, ensure regulatory compliance, and minimize potential organizational risks.

Communication skills

Communication skills are crucial for CCOs, as they need to build relationships with team members, regulatory bodies, and third parties.

They must understand technical jargon and translate compliance requirements into simple terms for non-technical stakeholders.

Excellent communication is also necessary for presenting detailed annual compliance reports. These skills ensure clear and compelling interactions, promote collaboration and ensure everyone understands compliance obligations.

Responsibilities of a chief compliance officer

The chief compliance officer is hugely significant in any organization and contains several crucial duties that keep the organization sustainable, successful, and safe.

Regulatory compliance requirement definition

The Chief Compliance Officer defines regulatory compliance requirements by meticulously interpreting laws, regulations, and industry standards relevant to the organization’s operations.

This task involves staying updated with regulatory changes, analyzing their impact, and translating them into actionable compliance measures.

By ensuring a clear understanding of these requirements across the organization, the CCO facilitates adherence and minimizes legal risks, leading to a compliant corporate environment.

Developing and revising the annual compliance work plan

The Chief Compliance Officer develops and revises the annual compliance work plan to align with regulatory obligations and organizational goals. This process involves assessing risks, prioritizing compliance activities, and allocating resources effectively.

The plan outlines critical compliance initiatives, timelines, and responsible parties, ensuring comprehensive coverage of compliance requirements.

Regular review and adjustment of the work plan enable the CCO to address evolving regulatory landscapes and internal priorities, promoting proactive compliance management and organizational resilience.

Overseeing the implementation of the compliance program

The Chief Compliance Officer creates an effective compliance program by interpreting regulatory requirements in the business context.

They map relevant controls to these requirements, draft policies and procedures, such as an AI acceptable use policy, and assign tasks to compliance teams for efficient implementation. This action ensures the organization meets legal obligations, mitigates risks, and maintains a culture of compliance.

The CCO’s efforts result in a well-structured, proactive approach to managing compliance across the company, safeguarding its operations and reputation.

Providing training

The compliance officer oversees workforce training and awareness initiatives, ensuring stakeholders grasp the significance of compliance and relevant requirements. They organize activities like phishing simulation exercises to reduce threats to sensitive information.

These efforts aim to educate employees on effectively identifying and mitigating risks.

By promoting a culture of vigilance and preparedness, the compliance officer strengthens the organization’s defenses against potential breaches and enhances the overall compliance posture across departments.

Providing strategic management support

The Chief Compliance Officer supports strategic management by aligning compliance objectives with business strategies. They can also influence new technology purchasing decisions using their knowledge of human-centred AI to ensure new tools comply with ethical considerations and regulations.

This process involves advising senior management on compliance risks and opportunities, integrating compliance into strategic planning processes, and advocating for resources to enhance compliance effectiveness.

By promoting a culture of compliance as a business enabler, the CCO helps drive sustainable growth and operational efficiency while mitigating regulatory risks.

Fraud vigilance

The Chief Compliance Officer oversees fraud vigilance efforts to detect and prevent fraudulent activities within the organization.

This task includes implementing fraud detection mechanisms, conducting regular audits and reviews, and promoting a zero-tolerance approach to unethical behavior.

By collaborating with internal audit, legal, and other relevant departments, the CCO ensures prompt investigation and resolution of suspected fraud cases.

Proactive fraud vigilance safeguards the organization’s assets, reputation, and stakeholder trust, reinforcing a culture of integrity and accountability.

Independent investigations

The Chief Compliance Officer conducts independent investigations into alleged violations of compliance policies and regulations. This action involves gathering evidence, interviewing relevant parties, and analyzing findings impartially.

The CCO ensures thorough, fair, and confidential investigations, adhering to legal and ethical standards. The CCO mitigates risks and preserves the organization’s integrity by promptly addressing compliance breaches.

Clear communication of investigation outcomes and recommended actions supports corrective measures and reinforces organizational compliance expectations.

Risk monitoring

The Chief Compliance Officer regularly conducts risk assessments to analyze diverse risks, including cybersecurity, operational, and financial risks, stemming from non-compliance.

Using a risk matrix, they assess the impact and likelihood of these risks and test disaster recovery and business continuity plans to gauge security maturity.

The CCO develops mitigation plans based on these assessments employing various risk response strategies. This proactive approach ensures readiness to address potential risks effectively, safeguarding the organization’s stability and resilience.

Consider these responsibilities of a CCO to ensure this role is right for your organization, and you can find the right person to fulfill these responsibilities in your enterprise.

Utilize a CCO to bridge compliance gaps

A Chief Compliance Officer (CCO) is essential for coordinating the bridging of organizational compliance gaps, using their vast knowledge and experience of regulation and compliance.

They bring expertise in regulatory requirements and industry standards, ensuring the company adheres to legal obligations.

CCOs also implement robust compliance programs, conduct regular audits, and train staff, promoting a culture of accountability.

By proactively identifying and addressing potential compliance issues, the CCO helps mitigate risks, protect the company’s reputation, and ensure smooth, compliant operations across all departments.

These actions avoid waste on security breaches, unlocking resources for innovation and increasing revenue.