In every area of work, people are finding ways to use ChatGPT. Insurance is no different. Industry insiders still haven’t decided whether ChatGPT will “revolutionize” the industry. But although we are hearing many promises that Generative AI won’t eliminate human roles, industry workers are naturally worried about how artificial intelligence might make life harder.

This article looks at the state of play in the middle of 2023. It will explain these areas:

- The existing role of AI in insurance companies.

- The leading research into Generative AI and insurance from McKinsey and Sprout.

- Some of the potential use cases for Chat GPT in insurance.

- The risks and limitations of using ChatGPT.

Although digital adoption in the insurance industry is a success story, Chat GPT still hasn’t taken hold across the insurance industry. But as we will see, we don’t need a crystal ball to explain how insurance companies could use this amazing new facility.

So – let’s take a dive!

- AI in the Insurance sector: is ChaptGPT doing anything new?

- Chat GPT insurance research

- ChatGPT for consumer insurance advice

- ChatGPT for insurance customer satisfaction

- ChatGPT for underwriting

- ChatGPT and producing documentation

- Risks of Chat GPT in insurance

- Chat GPT: An insurance revolution

- People Also Ask

AI in the Insurance sector: is ChaptGPT doing anything new?

We’ve got to clarify here – AI for insurance didn’t start with ChatGPT.

Far from it. The industry already uses AI to analyze customer data, produce more accurate pricing, and analyze claims data.

For fraud detection, AI can analyze vast amounts of historical data and identify patterns and anomalies that indicate potential risks or fraudulent activities. In claims processing, Natural language processing (NLP) algorithms can understand unstructured data from claim documents and extract the most relevant information in claims processing. And for underwriting, AI algorithms can quickly evaluate large volumes of data to make accurate decisions regarding policy approval, premium rates, and coverage levels.

Every insurance company knows about AI and machine learning already. So what’s different about Chat GPT?

ChatGPT is a generative AI engine based on a Large Language Model. That means:

- It is designed for natural language generation – offering conversational answers to questions.

- It uses its learning to generate generalized responses

- Capable of zero-shot learning – even if it hasn’t been trained in a particular area.

All these things make ChatGPT adaptable, entertaining, and with many open-ended possibilities. Developers can now access an incredible tool to deal with natural language inputs and perform tasks that seemed impossible just a year or two ago.

Chat GPT insurance research

Two of the most useful pieces of research about the status of AI and Chat GPT in insurance are McKinsey’s 2021 report called Insurance 2030 and the InsurTech company Sprout’s 2023 analysis, Generative AI in Insurance.

The McKinsey report investigates the applications and possibilities for AI in insurance. Some of the main findings include:

- An emphasis on an integrated and comprehensive customer insurance experience

- Discovering key trends driving AI, including the slew of information from connected devices; prevalent robotics (e.g., in cars); open-source data ecosystems; developments in cognitive technology.

- Potential future impacts could include much-reduced purchasing time, near-instant underwriting processes, and rapid claims based on masses of data.

On this basis – they advise that it’s important to stay informed about the latest AI technologies and to integrate them into your digital strategy.

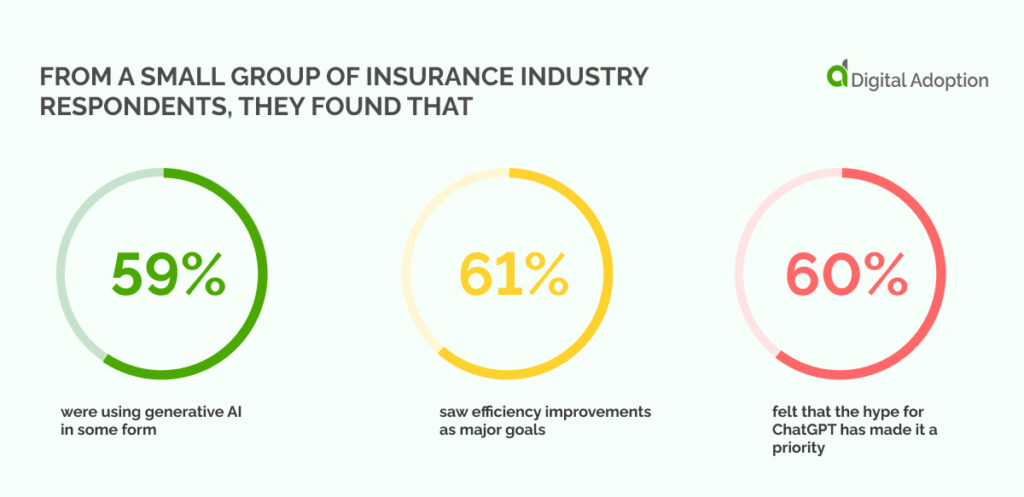

Bringing us up to date, Sprout’s 2023 report offers a timely insight into industry perceptions of Chat GPT. (That’s right: not just AI, but Chat GPT specifically). From a small group of insurance industry respondents, they found that

- 59% were using generative AI in some form.

- 61% saw efficiency improvements as major goals

- 60% felt that the hype for ChatGPT has made it a priority

It’s also important to note that only a few respondents (26%) saw ChatGPT as useful for legal, actuarial, and regulatory functions. This will be important when we think about the functions that Chat GPT could be used for – to which we will now turn!

ChatGPT for consumer insurance advice

Chat GPT is already good at giving consumer advice about insurance.

However, the advice is limited to the most generic inquiries. Ask for help with “how to find car insurance” or “how to find pet insurance.” You’ll get some suggestions. Ask something more specific like “How can I get the best home insurance for a house on a floodplain?” you’ll still get advice on navigating the terrain.

But once you ask for specific directions, you’ll quickly come up against the now-famous refrain – “Unfortunately, as an AI language model, I don’t have access to real-time data or the ability to provide specific quotes.”

With the right training, ChatGPT could provide responsive and useful answers. This would be a great solution for consumers – who might want to ask about specific information but now know where to look. Tools are already emerging to plug this gap.

ChatGPT for insurance customer satisfaction

Customer services is a major use case for Chat GPT. It’s an area where some of the biggest companies are starting to experiment.

Automated customer service solutions help to deliver great outcomes, and ChatBots are already an important part of the customer service landscape. ChatGPT could power a new generation of ChatBots, as long as it’s informed about the information for each insurance company.

Alternatively, ChaptGPT could support existing workers to provide better customer service. It could have the speed and accuracy that other knowledge bases can’t have for niche inquiries.

ChatGPT for underwriting

AI tools have already reduced the time spent on underwriting insurance claims. ChatGPT’s easy functionality means that it can be trained to:

- Discover the most important information in any given documentation

- Refer to existing guidelines

- Provide decision support with complex cases

In short, ChatGPT would not eliminate existing staff: but it would support the most difficult circumstances.

ChatGPT and producing documentation

If chat GPT is good for one thing, that’s quickly producing formulaic documentation.

Every stage of the insurance process relies on clear documents. For example:

- insurance policy

- Marketing materials

- insurance claims

- Communications

- Appeals letters (from the client side)

Generative AI has the power to produce accurate documentation in readable language. Chat GPT can be trained to adapt to the necessary protocols.

Of course, these outputs need to be double-checked by an experienced human. But ChatGPT produces the all-important first draft.

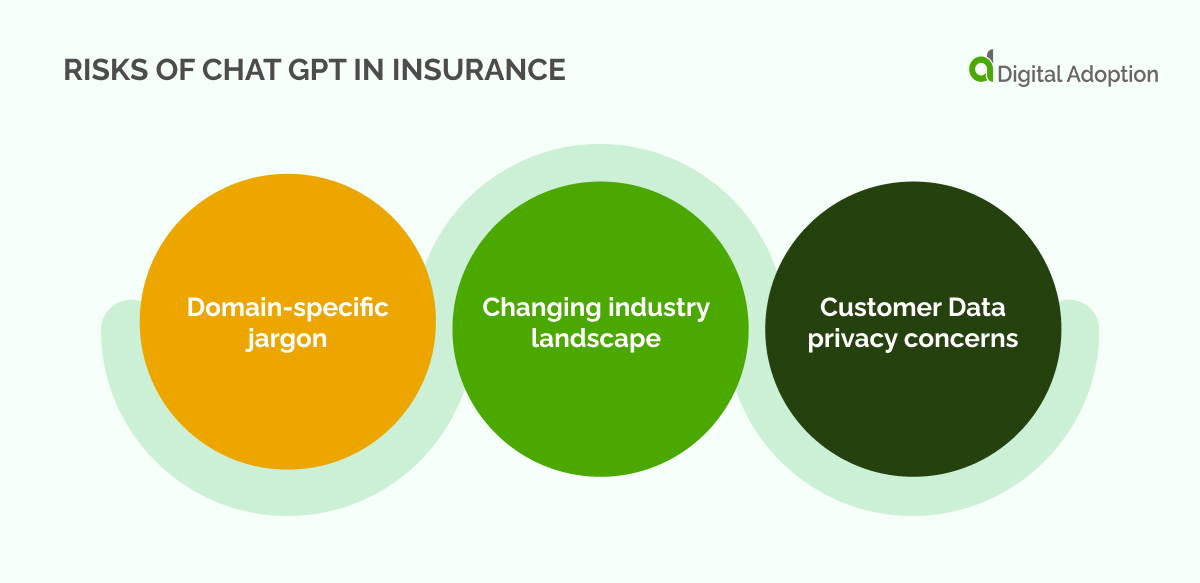

Risks of Chat GPT in insurance

So far, there are some definite possibilities for Chat GPT and insurance. However, we haven’t yet seen just what will take off. As such, It’s still a game of “wait and see” to figure out exactly how ChatGPT will impact the insurance trade.

But for all the excitement and hype, we should remember that there are also a lot of challenges.

Domain-specific jargon

ChatGPT doesn’t make sense of business-specific argot (or jargon) in many areas.

Can it give you an explanation that SOUNDS right? Yes. Is it right?

Hmm – maybe not. LLMs don’t “understand” words and messages like a human. All the chatbot does is use those words in an appropriate-sounding context. It will find a way to talk about loss ratios, subrogation, and exclusions: but there’s no guarantee it will get them right.

And what’s worse, ChatGPT is notorious for “hallucinating” key ideas and definitions. So the risks are pretty great.

As we learn how to train Chat GPT better, this problem will become less important. But for the time being, it must be trusted.

Changing industry landscape

ChatGPT had a knowledge cutoff in September 2021.

Yet the insurance industry continually evolves with new products, regulations, and emerging trends.

As it stands, ChatGPT cannot answer questions about the most up-to-date developments in the field.

Customer Data privacy concerns

Processing insurance inquiries relies on a lot of personal data. People in the life insurance industry reveal their family medical history, personal health issues, and other information they wouldn’t share openly.

Chat GPT introduces new problems across data-sensitive industries, introducing major risks to cybersecurity.

Companies know how to train a customer service representative to treat information with the utmost caution – and globally, plenty of regulations are in place to ensure they do. But we are still very early in understanding how ChatGPT might share or otherwise compromise confidential data.

This is a major responsibility on the side of companies. And we’ll likely see legislation emerging in the new feature.

Chat GPT: An insurance revolution

Let’s face it: we’re still living through the hype phase of ChatGPT.

It will certainly have important applications in many industries. But the mania will not last forever, and we might just find that ChatGPT isn’t as important as some people expect.

In short, it’s best to be patient. Industry insiders say the same thing. For example, Vinod Singh of Concirrus has recently urged caution around adopting ChatGPT in the insurance industry.

There are plenty of ways for ChatGPT to support insurance companies – today, tomorrow, and long into the future. There is plenty of interesting thought leadership in AI and ChatGPT from McKinsey, Sprout, and others.

These approaches show that ChatGPT could have applications in customer services, claims processing, and documentation. These opportunities come with major risks, which must be evaluated before moving forward.

People Also Ask

-

How can ChatGPT simplify complex insurance policy language for users?ChatGPT can analyze policy documents, breaking down coverage details, exclusions, and claims processes into plain English—making it easier for homeowners, renters, or landlords to understand their insurance.

-

Why are insurers using ChatGPT for empathetic customer communication?Generative AI models, like customized GPTs, help craft more empathetic, less jargon-heavy messages—improving claimant communication. Allstate, for instance, uses AI to draft most of its 50,000 daily customer communications, reviewed by humans.

-

When should insurance leaders address ChatGPT implementation risks?Insurers must assess confidentiality, automation bias, and intellectual property risks before deployment to ensure safe, compliant use of ChatGPT in business operations.

-

What if insurers rely heavily on ChatGPT for underwriting—what’s a potential downside?Overdependence on AI can lead to automation bias or opaque decisions without human oversight, potentially compromising risk assessment quality.