Like many other sectors, technology has long played an integral role in finance.

From digital databases that store our financial information to sophisticated systems that calculate complex transactions, the success of modern financial services is inherently linked to technology.

The rise of AI will only continue to impact banking and fintech. Major strides in data and computer sciences have seen AI graduate from the pages of science fiction. Today, AI’s applications are catapulting operational capabilities. Not just in finance but industry-wide.

The benefits of AI, from precise decision-making to pattern detection, position it as a catalyst for innovation.

In this article, we’ll explore AI in finance. We’ll define it and explore examples of how it’s used in the sector today. We’ll also uncover the top AI applications and tools the finance sector leverages.

What is AI in finance?

AI in finance involves augmenting financial services capabilities through artificial intelligence technology. Some forms of AI in finance involve training computers to learn and perform complex tasks without pre-programming.

Grandview Research reveals the global market for artificial intelligence in financial technology was worth 9.45 billion US dollars in 2021. They expect this market to grow steadily at 16.5% annually until 2030.

In finance, these systems primarily employ data-dependent AI, such as machine learning (ML) and deep learning (DL). ML in fintech teaches computers to automate activities and strengthen decision-making processes based on data they have learned.

Others often leverage rule-based AI for more acute processes, such as anomaly detection. These more stringent forms of AI are designed to identify and address specific issues with high precision.

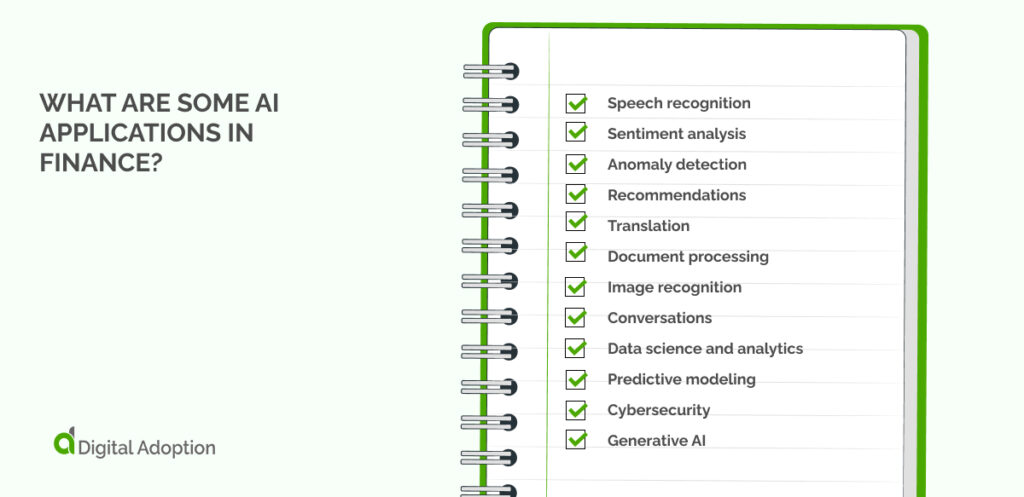

What are some AI applications in finance?

Artificial intelligence (AI) is revolutionizing the finance industry by introducing advanced applications that enhance decision-making and operational efficiency.

AI is reshaping how financial institutions manage risk and deliver personalized customer experiences.

Let’s take a closer look.

Speech recognition

Speech recognition enables users to interact hands-free with banking systems, enhancing security and convenience. Customers can authenticate transactions and access account details through voice commands.

In trading, speech recognition facilitates real-time updates and swift order executions. It also improves trader efficiency and responsiveness to market changes. It can accurately convert spoken words into actionable data, streamlining customer service and functional workflows within financial institutions. This enables intuitive user interfaces across digital platforms.

This is a pivotal advancement in user experience and operational resilience in the financial sector.

Sentiment analysis

Sentiment analysis uses natural language processing to interpret and quantify market sentiment from textual data sources.

This technology analyzes massive data sets from social media, news articles, and financial reports. It accurately assesses public perception and investor sentiment. Financial institutions use this analysis to make informed decisions about market trends, customer sentiment, and investment opportunities based on the tone and context of communications.

This real-time analysis helps adjust trading strategies and optimize risk management practices. It also ensures proactive responses to evolving market dynamics and enhances decision-making processes.

Anomaly detection

Anomaly detection is pivotal for identifying irregular patterns within extensive datasets. This technology detects unusual behaviors in transactions and market activities, enhancing fraud prevention and risk management strategies.

Advanced machine learning algorithms enable financial institutions to monitor and respond to anomalies in real-time. This helps fortify security and ensure operational resilience.

Anomaly detection also optimizes operational efficiency by pinpointing discrepancies in trading activities and market behaviors. It enables timely interventions to mitigate risks and enhance overall performance.

Recommendations

AI algorithms generate recommendations that provide valuable insights into financial decision-making. They analyze historical data, market trends, and customer behaviors to offer personalized investment advice and portfolio recommendations.

Machine learning models empower financial advisors to optimize asset allocation strategies, which can be tailored to individual risk profiles and financial goals. AI-driven recommendations enhance customer engagement by delivering timely insights and actionable suggestions, which breeds trust and satisfaction.

Integrating these technologies empowers financial institutions to offer more informed, responsive, personalized services. This improves client outcomes and drives competitive advantage in the evolving financial landscape.

Translation

AI-powered translation capabilities are transforming finance by breaking language barriers and facilitating seamless communication across global markets.

This technology ensures accurate and efficient financial documents, reports, and communications translation. It also enables international collaboration and regulatory compliance for financial institutions. It leverages neural networks and NLP to confidently engage with stakeholders worldwide, allowing them to translate complex financial information accurately while preserving context.

AI-driven translation tools streamline operations, enhance transparency, and support decision-making by providing timely access to multilingual data and insights. This capability is crucial in expanding market reach, boosting global partnerships, and driving innovation within the financial industry.

Document processing

Intelligent document processing automates and optimizes the handling of extensive paperwork and digital documents.

This technology swiftly extracts and analyzes data from forms, contracts, and financial statements. Machine learning algorithms streamline document workflows, reducing manual errors and processing times for greater efficiency. It also enhances compliance with regulatory standards by facilitating consistent and thorough document analysis.

It enables rapid information retrieval, supports informed decision-making, and boosts overall operational efficiency. This empowers professionals to focus on strategic initiatives while upholding data integrity and security standards.

Image recognition

Image recognition technology in finance is changing how institutions analyze and use visual data.

It automates the analysis of images like checks, IDs, and financial documents. This improves processes such as document verification and fraud detection. Advanced algorithms help financial entities interpret and extract information from images, minimizing errors.

Image recognition also enhances customer experience by enabling faster and more secure document handling, ensuring compliance with regulatory standards. This technology fosters innovation in financial services by integrating visual data into decision-making processes, enhancing risk management and operational insights.

Conversations

Conversations in finance are being transformed through advanced digital communication tools that facilitate seamless interaction between institutions and clients.

These tools enable real-time dialogue across multiple platforms, enhancing customer engagement and satisfaction. Financial organizations leverage these capabilities to provide personalized assistance, address inquiries promptly, and offer tailored solutions.

Efficient communication channels, like interactive websites and mobile apps, allow institutions to optimize service delivery and ensure customers receive a responsive experience. Conversations also play a crucial role in internal operations, enabling collaboration and knowledge sharing.

Data science and analytics

Data science and analytics are essential tools in finance. They help institutions analyze large datasets to make informed decisions and improve operations.

These fields use statistics and models to find trends in financial data. Financial companies use them to manage risk better, invest smarter, and work more efficiently.

Data insights also help understand customers, personalize services, and predict market trends. These skills are like a superpower, helping them follow rules, innovate, stay competitive, and gain valuable insights.

Predictive modeling

Predictive modeling is essential in modern finance. It utilizes statistical methodologies to forecast future trends and behaviors based on historical data analysis.

This method enables financial institutions to anticipate market movements, understand customer preferences, and optimize investment strategies. Predictive modeling identifies patterns and correlations within datasets. This helps mitigate risks, allocate resources effectively, and improve operational efficiency.

It also supports personalized customer interactions and targeted marketing efforts, enhancing service delivery and customer satisfaction. Ultimately, predictive modeling empowers finance professionals to navigate uncertainties and capitalize on opportunities in a dynamic economic environment.

Cybersecurity

Cybersecurity is critical in the finance sector. It ensures the protection of sensitive information and transactions from cyber threats.

Financial institutions need strong cybersecurity. It protects client data and builds trust. They use effective strategies and technology. This keeps data safe, blocks unauthorized access, and reduces cyberattack risks.

Strong cybersecurity helps them follow regulations, stay financially stable, and make operations more resilient. They achieve this with advanced encryption, multi-layered authentication, and continuous monitoring to find and respond quickly to threats.

Prioritizing cybersecurity also safeguards client assets and reinforces digital trust in financial services.

Generative AI

Generative AI is reshaping finance using computational algorithms to create novel data and simulations that simulate real-world scenarios.

Generative AI is transforming finance with powerful computer programs. These programs create realistic fake data for testing and training. This fake data helps build better models to predict the future and manage risks.

Generative AI also analyzes customer behavior and preferences by recommending personalized financial products and services.

It also supports decision-making processes by providing insights derived from complex data analysis. Generative AI empowers finance professionals to improve operational efficiency and deliver enhanced customer experiences in an increasingly data-driven world.

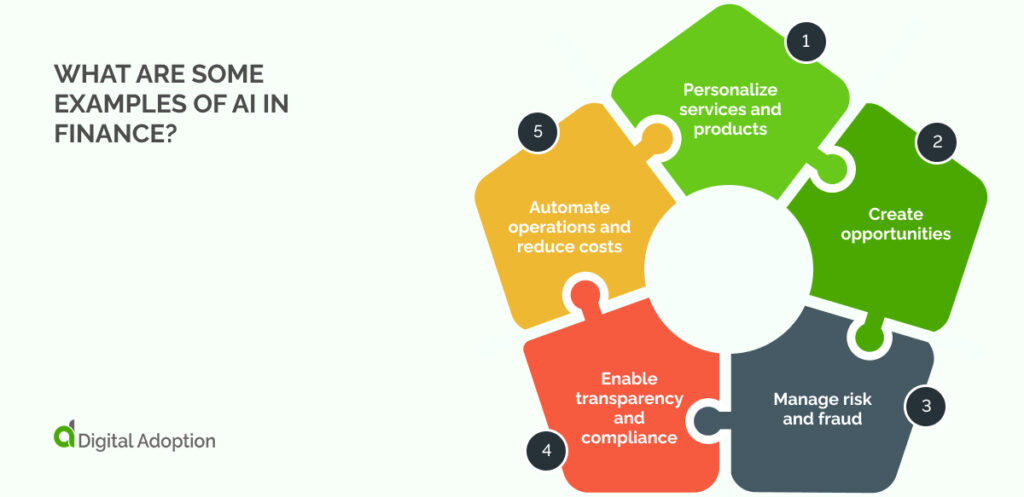

What are some examples of AI in finance?

Understanding examples of AI in finance is crucial as it illustrates how technology enhances efficiency, innovation, and regulatory compliance in the industry. AI’s impact reshapes operations and decision-making paradigms from automating complex processes to predicting market trends.

Personalize services and products

AI enables financial institutions to personalize services and products for their customers. AI algorithms can identify individual preferences and behaviors by analyzing vast data sets.

Banks can offer tailored financial advice, customized investment portfolios, and personalized banking services. For instance, AI-driven chatbots provide real-time assistance, while machine learning models predict customer needs and suggest relevant financial products. Personalized services enhance customer satisfaction and loyalty, driving better engagement and retention.

AI’s ability to deliver bespoke financial solutions transforms the customer experience, making it more intuitive and responsive to individual needs.

Create opportunities

AI creates numerous opportunities in the finance sector by optimizing processes and uncovering new revenue streams.

Powerful data analysis and machine learning are giving financial companies a big edge. They can now spot upcoming market trends, better assess investment risks, and even create new financial products. AI can also trade super fast using complex computer programs, making better decisions than humans in a fraction of a second.

Additionally, AI-driven fraud detection systems help secure transactions and build customer trust. By leveraging AI, financial firms can streamline operations, reduce costs, and capitalize on new business opportunities, ultimately driving growth and maintaining a competitive edge in the industry.

Manage risk and fraud

AI plays a crucial role in managing risk and fraud in the finance sector. Advanced machine learning algorithms analyze vast datasets to identify unusual patterns and behaviors indicative of fraudulent activities.

Financial institutions are deploying real-time monitoring systems powered by AI. These systems detect and flag suspicious transactions, significantly reducing fraud. AI-driven risk management tools assess creditworthiness more accurately than traditional methods.

They can predict potential defaults with greater precision. These adaptive AI systems enhance their predictive capabilities by continuously learning from new data. This provides financial institutions with robust tools to mitigate risks and safeguard assets.

A proactive approach significantly strengthens the security and reliability of financial operations.

Enable transparency and compliance

AI is becoming a game-changer for financial institutions, promoting both transparency and compliance.

Advanced algorithms can quickly analyze massive datasets, automating regulatory checks and ensuring companies follow the rules. These AI tools also act as watchdogs, identifying irregularities and guaranteeing accurate reporting. Real-time transaction monitoring further strengthens compliance efforts.

By integrating AI solutions, financial companies streamline operations and build trust with regulators and clients. They can ultimately create a more stable and transparent economic environment. This approach mitigates risks and promotes a healthy financial system for long-term growth.

Automate operations and reduce costs

AI’s powerful automation is transforming efficiency and costs in finance. Advanced algorithms and machine learning streamline tasks like data entry, reconciliation, and customer service. This speeds things up and ensures accuracy, boosting overall efficiency.

AI goes a step further with predictive analytics. Analyzing past data and forecasting trends helps allocate resources wisely and avoid unnecessary spending. These AI technologies deliver significant cost savings and make resource allocation more flexible. This keeps financial firms competitive in today’s dynamic economy.

AI’s future impact on finance

The future of AI in finance promises a dramatic transformation. Cutting-edge technologies will revolutionize traditional practices, driving innovation across the industry.

Integrating artificial intelligence into financial services will deliver significant benefits as it evolves. We can expect enhanced efficiency, improved decision-making, and a profound reshaping of how customers interact with financial services.

AI’s role in personalized finance is set to redefine customer experiences. AI can analyze customer behaviors and preferences through sophisticated algorithms and natural language processing to offer tailored financial advice and product recommendations. This improves customer satisfaction and deepens client engagement and loyalty.

AI-driven automation is also expected to streamline operational processes within financial institutions. Tasks such as document processing, compliance monitoring, and fraud detection can be performed more efficiently and accurately through AI technologies, freeing human resources for more strategic and value-added activities.Looking ahead, the adoption of AI in finance is backed by promising data and real-world examples showcasing its benefits. For instance, the Government Office for Science has demonstrated that AI-powered trading algorithms can outperform human traders in speed and accuracy, improving investment outcomes.