Digital products had already penetrated the insurance sector, making it an early adopter—but the pandemic has increased penetration even more and made digital inevitable. More and more Insurance company CEOs realize that digitization not only helps their customers but also helps them cut costs. So, there has been a surge in investment into insuretech companies—businesses that use technology to make the insurance industry more efficient. Venture capitalists are pouring money into these innovative products.

More importantly, the statement that “digitization will help insurance firms” is no longer a matter of conjecture but a verifiable fact. Profit statements from around the world show that firms that took to digitization have cornered the lion’s share of the sector’s profits, while those who are just now getting on board are struggling.

All this aside, there are glitches in digital implementation. For example, many customers still feel they need help processing insurance claims digitally—complaining that interfaces are slow and difficult to navigate.

- How the Pandemic Impacted Digitization of Insurance Operations?

- What Are the Obstacles in an Insurance Company’s Digitisation Journey?

- Will Digitisation Help Reduce an Insurance Company’s Expenses?

- Does Innovation and Digitalization Work for Insurance Firms?

- Is Digital Insurance Claiming Process Glitch-Free?

- Conclusion

How the Pandemic Impacted Digitization of Insurance Operations?

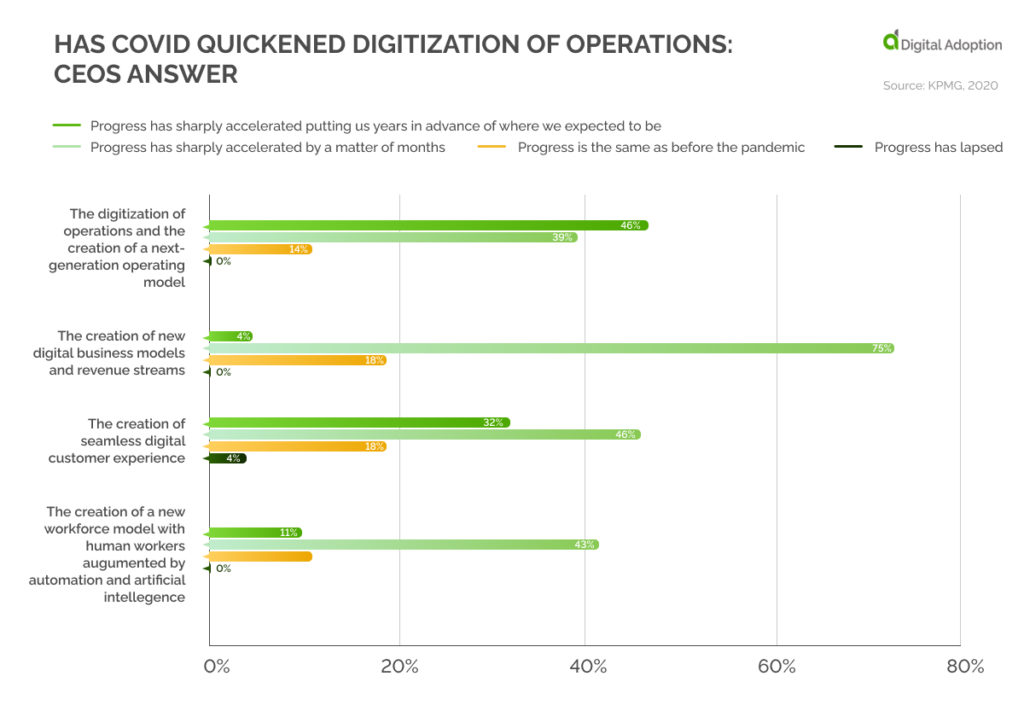

A survey of Insurance CEOs conducted by KPMG International found that 46% felt the pace at which their organizations were digitizing operations had increased dramatically after the pandemic—putting them years ahead. Moreover, 75% of the CEOs surveyed said that creating new digital business models and revenue streams have accelerated by a matter of months. About 46% said they had seen an exponential increase in the rate at which companies were creating a seamless digital customer experience.

See chart 1 for the results of KPMG’s CEO outlook survey conducted in 2020, a special edition during the pandemic. Interestingly, only on very few occasions had they said that progress towards achieving any digitization goal might have lapsed.

Chart 1

What Are the Obstacles in an Insurance Company’s Digitisation Journey?

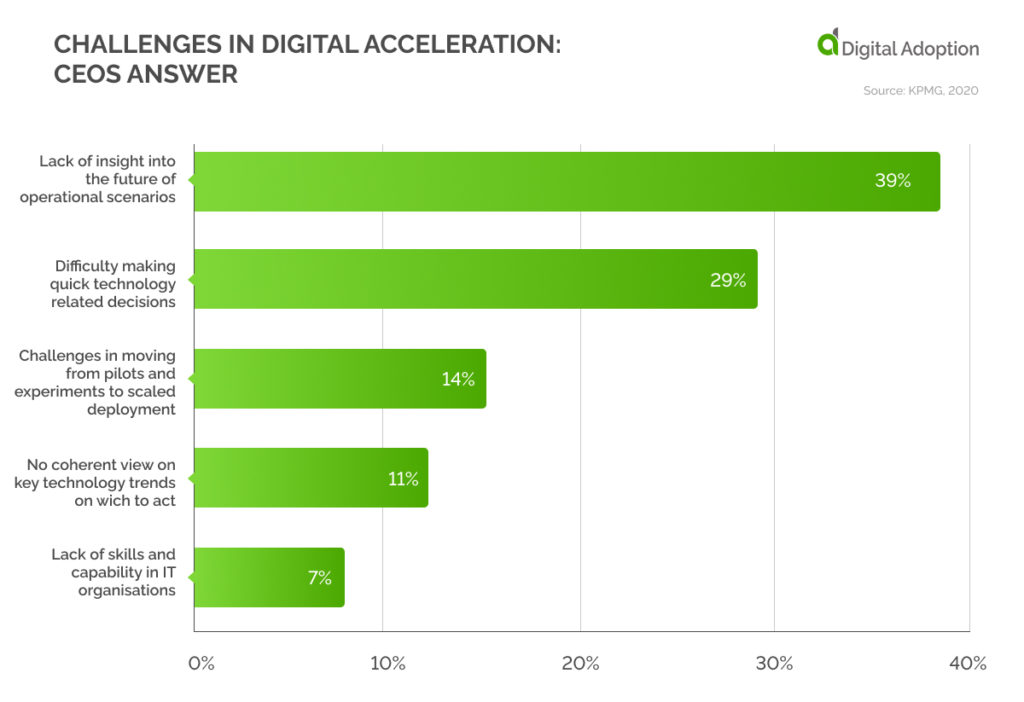

Although the CEOs surveyed by KPMG were optimistic about their companies’ digital transformations, they listed several challenges that stood in the way of these efforts.

The chief obstacle behind the digitization of processes seems to be a lack of vision about future operational scenarios. An operation scenario is “an imagined sequence of events that includes the interaction between, for example, a company’s product or service and its users.”

CEOs of insurance companies have admitted that their biggest fear when embracing digital transformation is uncertainty over how customers will react. This growing technology poses a big question for insurance companies: how can they implement it while ensuring that customers continue to trust them?

Chart 2

Will Digitisation Help Reduce an Insurance Company’s Expenses?

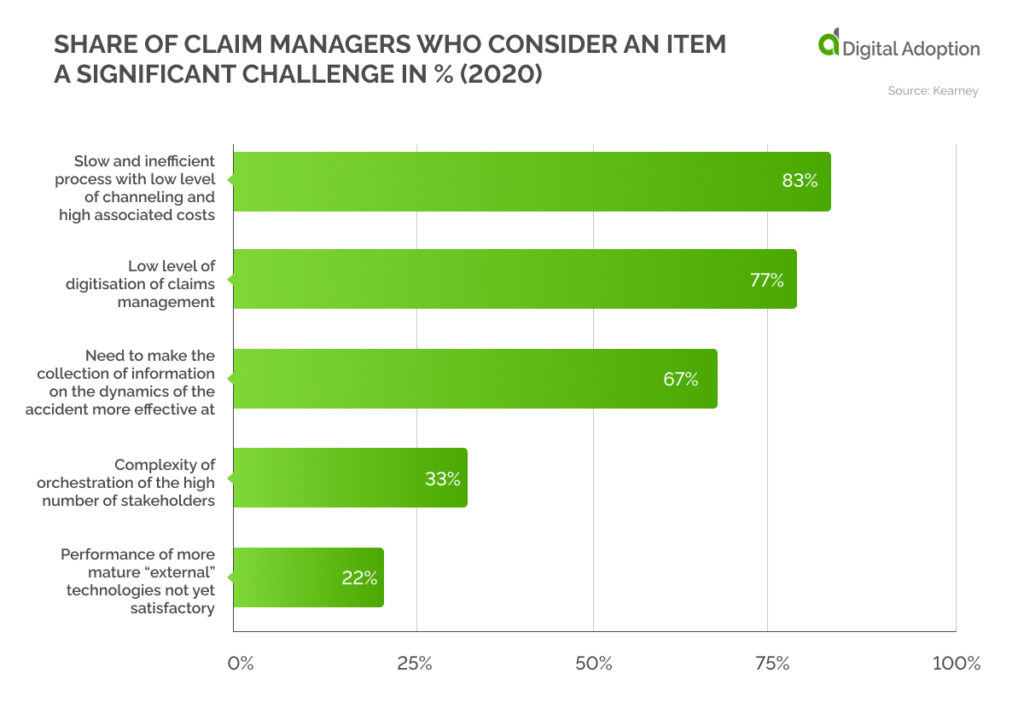

Not only does digitization lead to better customer service, but it also reduces costs for insurance companies. A recent survey conducted by management consulting firm Kearney shows that insurance claim managers at leading companies say they were able to reduce the amount of money spent on processing claims due to digitization. About 83% of participants said that a slow and inefficient insurance claim process leads to high associated costs.

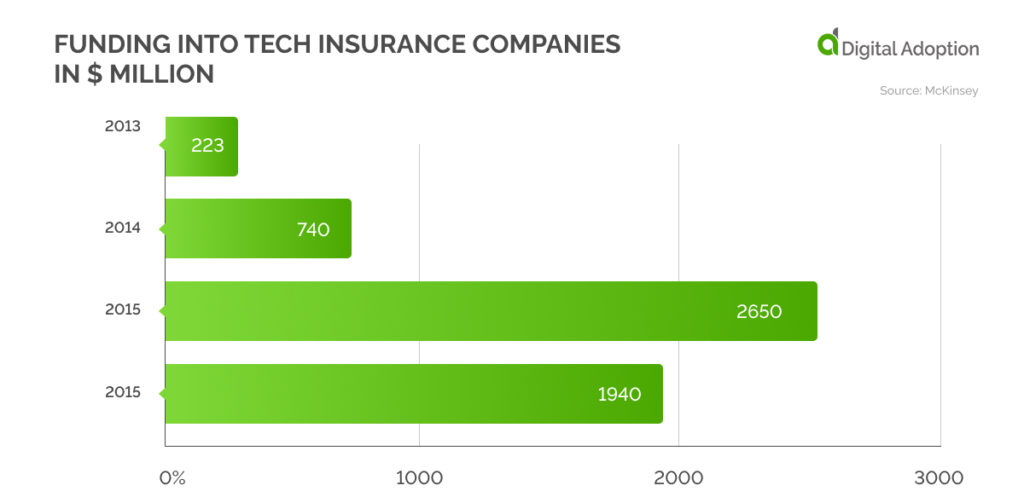

Are the Tech-Based Insurance Companies Getting Funds?

In 2015, venture capitalists invested nearly $2.6 billion in insuretechs— see chart 3A for the year-wise funding details. Also, interestingly, these new firms are concentrating more on property and casualty insurance than on life and health products.

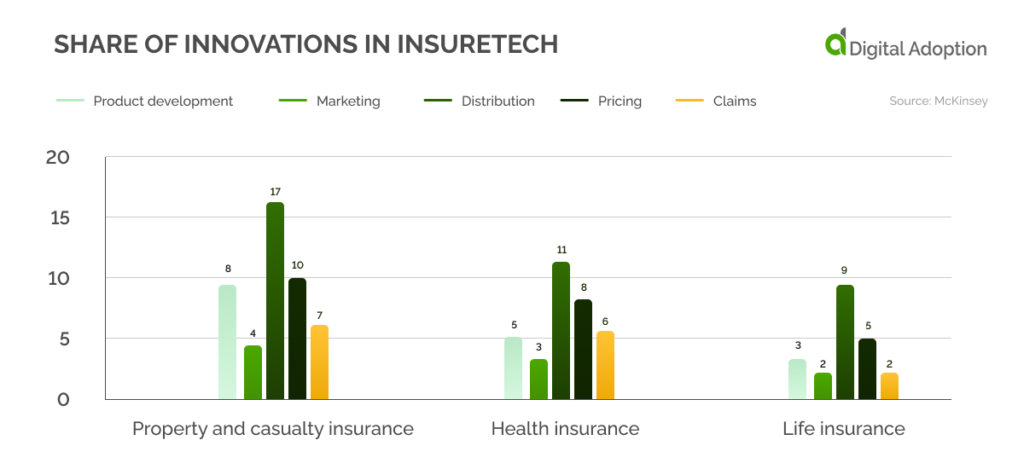

Chart 3B shows the share of all innovations recorded in the insuretech database. It is evident from this study that these companies are concentrating on the distribution part of their product and spending little time on marketing or claims divisions.

Chart 3A

Chart 3B

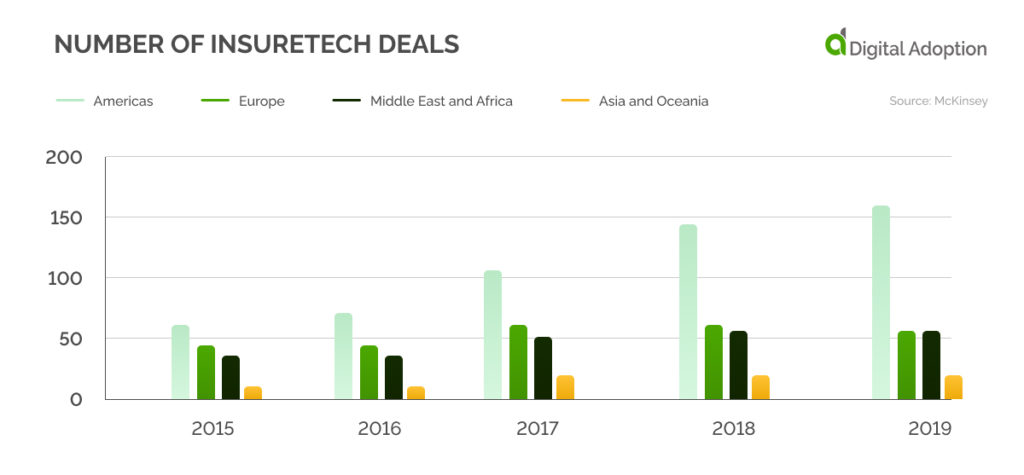

Kearney, a leading global management consulting firm, reports that investments into insuretech (the convergence of information technology and insurance) have increased dramatically. Notably, such deals are on the rise not only in the Americas but also in Europe—to an extent even in Middle East & Africa. The Chart 3C shows the number of insuretech deals in select regions.

Chart 3C

Does Innovation and Digitalization Work for Insurance Firms?

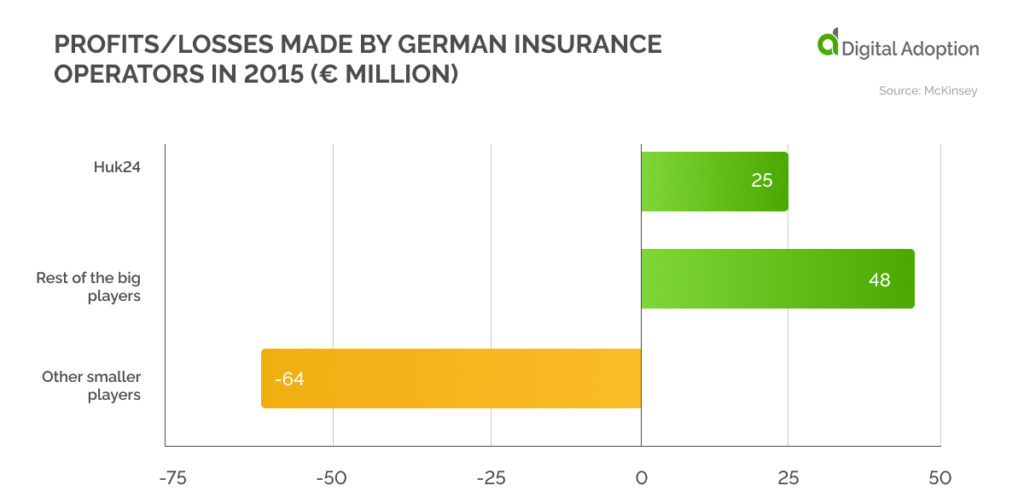

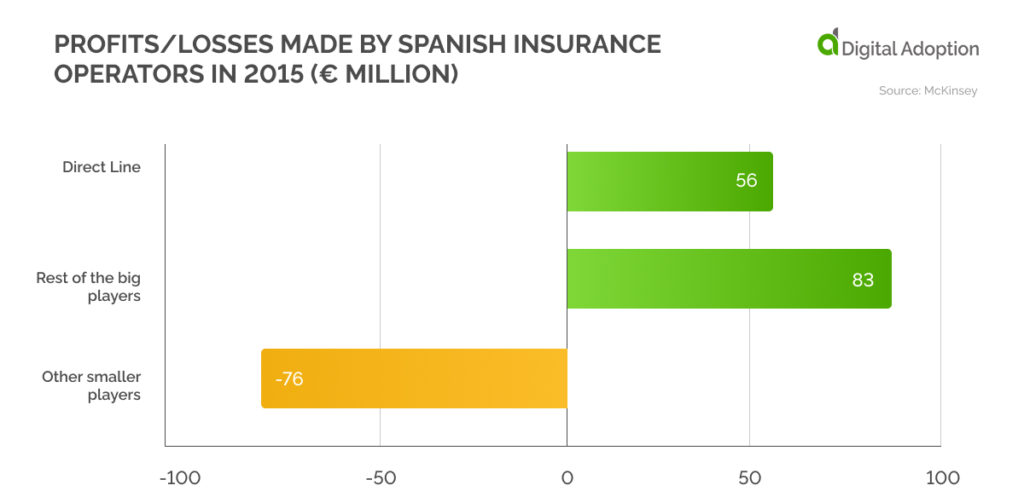

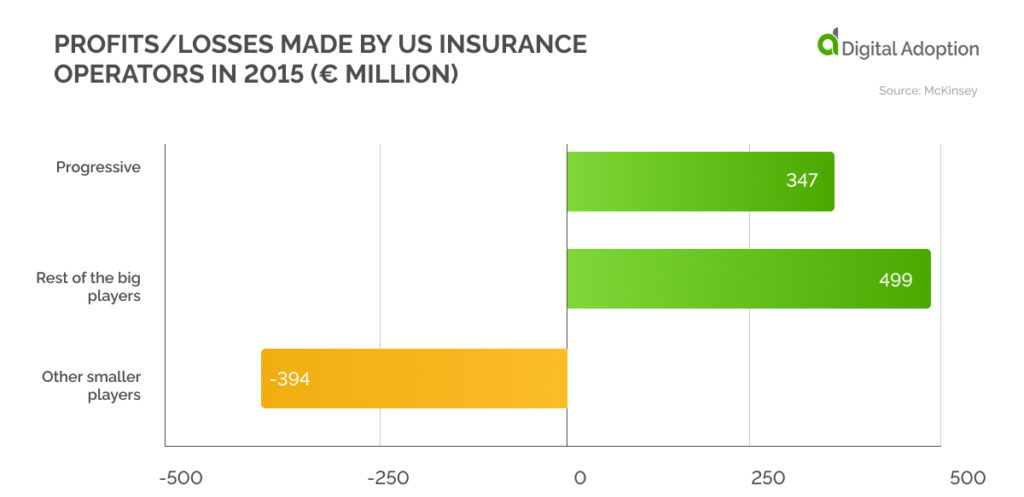

Insurance companies should get into the game as quickly as possible in an increasingly digital world. There is enough evidence to show that getting digitized sooner helps to create an edge over competitors. For instance, in direct auto insurance in Spain, Germany, and the United States, a single player has cornered a very high share of the profits.

Charts 4A, 4B, and 4C demonstrate how three players — Huk24 in Germany, Direct Line in Spain, and Progressive in the United States — took home a large share of the profits. And these three players were the first movers to digitalize their insurance products.

As seen from the charts, the industry rewards those who innovate, particularly those who do so early. Getting stuck in a business routine and refusing to experiment digitally will lead to heavy losses.

Chart 4A

Chart 4B

Chart 4C

Is Digital Insurance Claiming Process Glitch-Free?

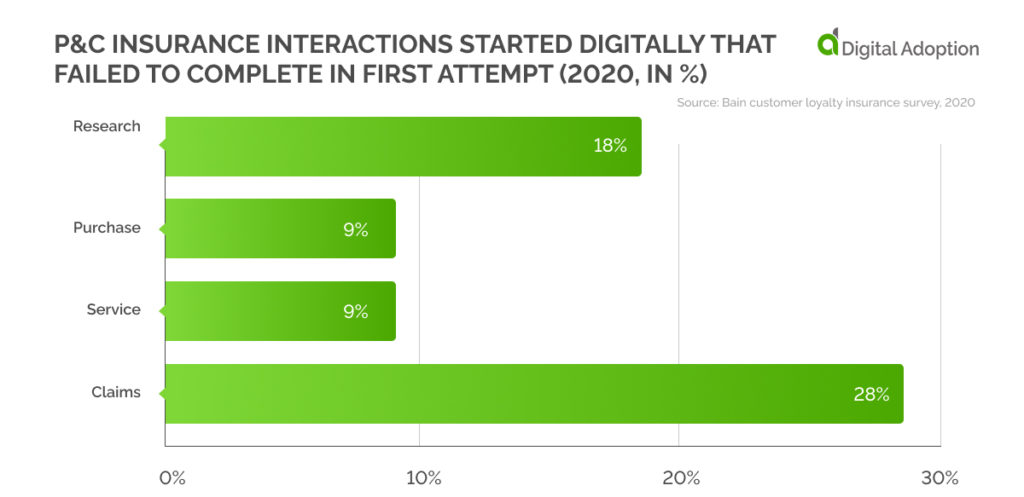

Yes and No. Most customers have had a smooth transition to digital insurance, but some—especially those trying to file claims—have reported glitches in the system.

In a survey sponsored by Bain & Company and conducted by Dynata across 17 countries covering 135,000 consumers, 28% of customers who tried to claim their insurance said that their initial transactions started digitally and failed in the first attempt. About 18% of respondents also said their initial attempts failed when researching insurance products.

Chart 5A

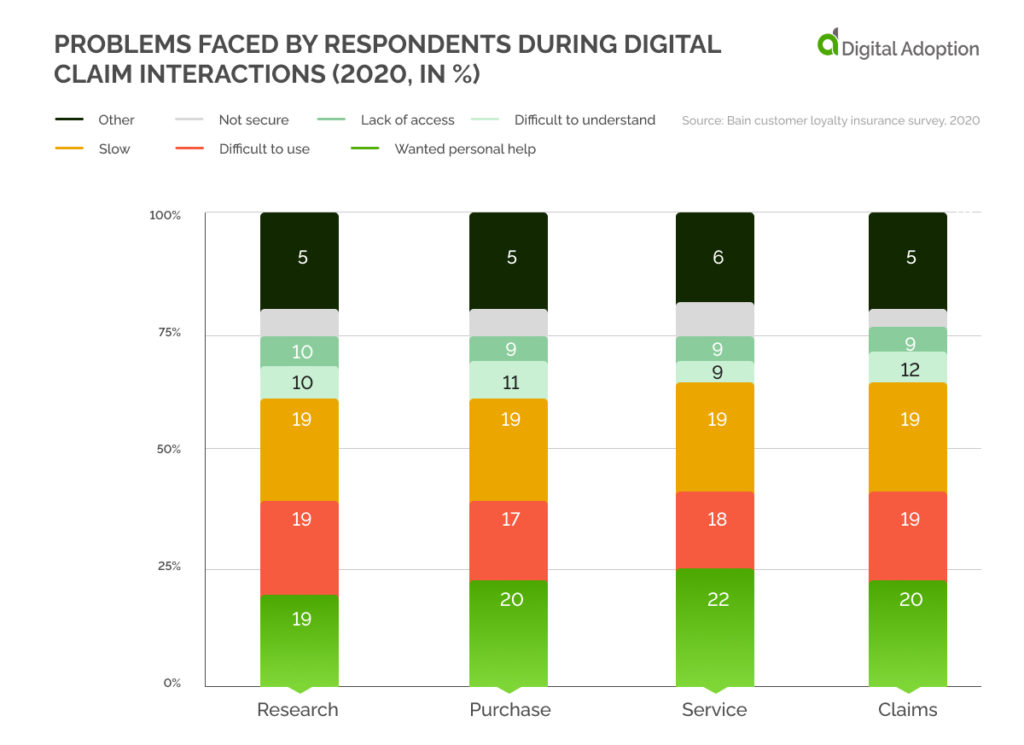

About 20% of customers said they needed personal help while accessing digital insurance products, and a similar share complained that the systems were slower than manual transactions.

Chart 5B gives a detailed split of the various issues faced by insurance customers during digital claim interactions.

Chart 5B

Conclusion

The results are precise: Insurance firms must warm up to the digital challenge. The sooner they do so, the better for them—and their customers. Data shows that those companies which reacted quicker and digitized their products earlier reaped the rewards—while others who did not failed due to lacking innovations. However, while companies transform their products, they should keep an eye on customer satisfaction and lend an ear to subscriber needs. Increasingly insurance subscribers are complaining a lot about the claims interface of firms— especially about the complexity of their websites.

![4 Best AI Chatbots for eCommerce [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/03/4-Best-AI-Chatbots-for-eCommerce-2025-img-300x146.jpg)

![13 Digital Transformation Enablers [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/02/13-Digital-Transformation-Enablers-2025-img-300x146.jpg)

![4 Best AI Chatbots for eCommerce [2025]](https://www.digital-adoption.com/wp-content/uploads/2025/03/4-Best-AI-Chatbots-for-eCommerce-2025-img.jpg)